Tax Credits

The Cultural Trust tax credit is a unique way for the state to fund cultural activities in the state into perpetuity. To qualify, you need to first make a donation to one or more of the 1400+ nonprofits on our list. Then make a matching gift to the Oregon Cultural Trust on our website or via mail. Oregonians who pay state income tax will get the credit back – dollar for dollar – on their tax return. It costs them nothing.

A tax credit reduces what you owe the State of Oregon. It’s a much greater savings than a deduction, which only reduces the income on which you are taxed.

The Cultural Tax Credit is a nonrefundable credit. The credit cannot be carried over to another tax year and only applies to your State of Oregon tax liability for the year when you make your contribution. However, the tax credit can be used to help reduce a filer’s tax to pay. For example, a $500 tax credit may help reduce a $1,200 tax liability to $700.

The ORS for Trust for Cultural Development Account contributions is 315.675. Subsection (5)(a) specifically states the credit may be up to $1,000 for a taxpayer filing a joint return or $500 for a taxpayer filing any other type of return. In addition, Oregon Publication 17 has a section explaining the Oregon Cultural Trust Contributions. Taxpayers may get a credit of up to 100 percent of the amount of the matching contribution, to a maximum credit of $500 per taxpayer ($1,000 on jointly filed returns).

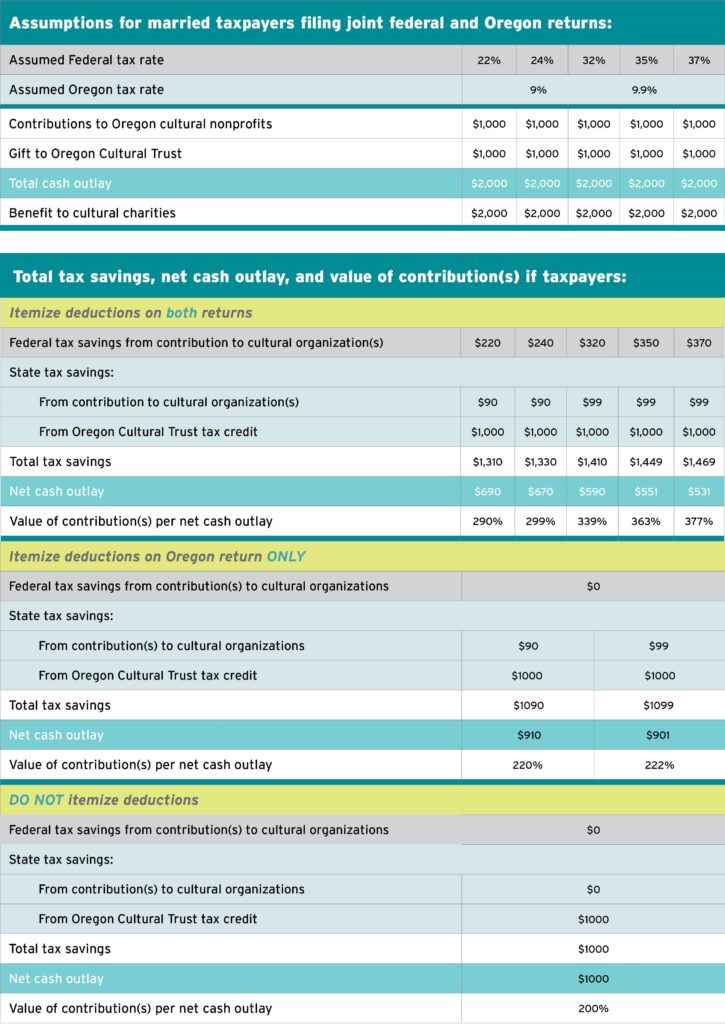

(prepared by the Oregon Department of Revenue and the Cultural Trust)

The following examples and chart provides guidance, individual tax circumstances may be different. These examples assumes a couple is filing jointly and is eligible for the maximum Cultural Trust tax credit of $1,000. A single file is eligible for a maximum of $500.

The Cultural Tax Credit is a nonrefundable credit. The credit cannot be carried over to another tax year and only applies to your State of Oregon tax liability for the year when you make your contribution. However, the tax credit can be used to help reduce a filer’s tax to pay. For example, a $500 tax credit may help reduce a $1,200 tax liability to $700.

Itemizing Guidance (not including the Trust tax credit as a federal tax deduction)

If the joint filers are in the federal 32% rate and 9% rate for Oregon and donate a total of $1,000 to eligible cultural nonprofits, they are eligible to claim deductions for $320 tax savings on the federal return and $90 for state return. The taxpayers tax saving would be $410.

If the same taxpayers also contributed $1,000 to the Cultural Trust, and that amount is not claimed as a deduction on federal tax returns, the contribution is eligible for the Trust tax credit. The Oregon tax saving would be $1,000.

The total combined tax savings would be $1,410. The taxpayers gave a total of $2,000 to cultural nonprofits and the Trust and total cash outlay was only $590.

Standard Deduction Guidance (itemize deductions on the Oregon return only)

If the joint filers are in the federal 32% rate and 9% rate for Oregon and donate a total of $1,000 to eligible cultural nonprofits and do not itemize on their federal return they are not eligible to claim those contribution to cultural nonprofits as deductions on their federal return. There would be no tax savings for these donations if they are claiming the standard deduction. The contribution of $1,000 would be eligible as a deduction the Oregon tax return, the tax savings would be $90.

If the same taxpayers also contributed $1,000 to the Cultural Trust, and that amount is not claimed as a deduction on federal tax returns, the contribution is eligible for the Trust tax credit. The tax saving would be $1,000.

The total combined tax savings would be $1,090. The taxpayers gave a total of $2,000 to cultural nonprofits and the Trust and total cash outlay was only $910.

No Itemized Deduction on federal or state taxes

If the joint filers do not itemize on either federal or state taxes they may not claim the donations to cultural nonprofits on either tax returns. There would not be a tax savings.

If the same taxpayers also contributed $1,000 to the Cultural Trust, and that amount is not claimed as a deduction on federal or state tax returns, the contribution is eligible for the Trust tax credit. The tax saving would be $1,000.

The tax savings would be $1,000. The taxpayers gave a total of $2,000 to cultural nonprofits and the Trust and total cash outlay was only $1,000.

Exception

If your contribution to the Trust is above the maximum tax credit limit, you can claim the amount over the limit as a deduction on your state and federal returns as long as you itemize on both returns. For example: If you are eligible for a maximum $1,000 Trust tax credit and you donate $1,500 to the Trust, you can claim the $1,000 Trust tax credit and the over amount of $500 on your federal and Oregon tax returns.

Why doesn’t every Oregonian do this?

Most Oregonians don’t know about it, or think it’s complex to do. But making a matching contribution and claiming it on your tax return is very easy. Some might also forget to make their donation before Dec. 31.

The Oregon Cultural Trust is a tax-exempt organization under Chapter 170(c)(1) of the Internal Revenue Code and our tax id number is 93-0621491.

The contribution to the Trust can either be claimed as a deduction on your federal taxes OR as an Oregon state Trust tax credit. You cannot claim the state tax credit and also deduct it on your federal tax return. See below for examples.

Exception

If your contribution to the Trust is above the maximum tax credit limit you can claim the amount over the limit as a deduction on your state and federal returns as long as you itemize on both returns. For example: If you are eligible for a maximum $1,000 Trust tax credit and you donate $1,500 to the Trust, you can claim the $1,000 Trust tax credit and the over amount of $500 on your federal and Oregon tax returns.

Itemizing Guidance

If you itemize your deductions and you include the contribution to the Trust that contribution is eligible as a deductible on your federal income tax return. If you claim the Trust contribution as a deduction on your federal returns, you will need to add that amount back to your taxable income on your Oregon tax returns.

Standard Deduction Guidance

If you do not itemize your deductions on your federal income tax return, you are eligible to claim the Trust tax credit on your Oregon returns up to the allowable limit.

Oregon taxpayers should consult with their accredited tax preparer regarding the availability to take the deduction on the Federal return while also taking a credit on the Oregon return for the same donation.

Yes, but they are generous: up to $500 for an individual, $1,000 for couples filing jointly and $2,500 for Class-C corporations. You must have Oregon tax liability in order to claim the tax credit. You can claim the tax credit year after year, but you cannot carry it forward from one year to the next. If you do not itemize your deductions on your federal income tax return, you may still claim the Oregon cultural tax credit on your state returns up to the allowable limit. Oregon taxpayers should consult with their accredited tax preparer regarding the availability to take the deduction on the Federal return while also taking a credit on the Oregon return for the same donation.

Yes, although many Oregon taxpayers will likely take the standard deduction due to recent change in tax law, while still choosing to support charitable cultural nonprofits with a donation. Even if you choose not to itemize your taxes, you can make a matching gift to the Cultural Trust for a 100% state tax credit. Be sure to consult with your tax preparer for which approach best suites your financial situation. A gift to a cultural nonprofit and the Cultural Trust remains a win-win!

The cultural tax credit is claimed using code 807 on Schedule OR-ASC, Section C, Standard Credits, or Schedule OR-ASC-NP, Section E. This amount is carried over onto the tax return using the following lines: Form OR-40, line 25; Form OR-40-N, line 50; or Form OR-40-P, line 49 (N stands for non-residents, P stands for part-time residents).

Users of Tax Software: In the list of “Standard Credits,” you’ll see “Oregon Cultural Trust.” Enter the amount you gave to the Cultural Trust there. It might also be referred to as the “Cultural Development Fund“.

Turbo Tax users: In your Oregon State return it is listed under “Uncommon Oregon Credits.” Check the box next to “Donated to an Oregon nonprofit and the Trust for Cultural Development Account.”

Trust donors should consult a tax preparer should they have any questions about their unique filing circumstances.

Please note the FAQ section describes how the Cultural Trust tax credit works; tax information and examples from the Oregon Cultural Trust is intended for use as a guide and not as official tax advice. Individual tax circumstances may be different. The Cultural Trust cannot provide tax advice and cannot assume authority in tax matters. Oregon taxpayers should consult with their accredited tax preparer when planning their charitable giving.

Making Your Donation

Nope. This was set up by the Oregon legislature to provide funding for culture regardless of federal funding priorities. This is the kind of creativity and innovation you’d expect from the state that brought us the bottle bill and public beaches!

Yes. ORS 315.675 (2) allows a taxpayer to take a credit toward taxes, as long as a donation to an Oregon nonprofit cultural organization is done and a matching donation to the Trust for Cultural Development Account (Cultural Trust) is made.

Total all of your donations, over the year, to one or more of the participating cultural nonprofits and then make a donation to the Cultural Trust of an equal amount (i.e. $500 total to OPB, High Desert Museum, Oregon Shakespeare Festival, Oregon Bach Festival and Columbia Arts + $500 to Oregon Cultural Trust). The donation you make for $500 to the Cultural Trust will come back to you dollar-for-dollar when you claim your cultural tax credit.

The Cultural Tax Credit is a nonrefundable credit. The credit cannot be carried over to another tax year and only applies to your State of Oregon tax liability for the year when you make your contribution. However, the tax credit can be used to help reduce a filer’s tax to pay. For example, a $500 tax credit may help reduce a $1,200 tax liability to $700.

Yes, the Oregon Cultural Trust has an account within the Oregon State Treasury at the State Street Bank Trust.

The Oregon Cultural Trust is happy to accept contributions of stock. Instructions on making a transfer can be found by clicking here.

Stock transfers usually take several business days to process – and we request that you contact our office at least one business day prior to making the transfer so we have it set up. Once we have been notified your broker may implement the transfer for your tax credit. Once the transfer is complete we will send you a letter acknowledging your contribution.

If you have questions about gifts of stock, contact Raissa.Fleming@oregon.gov or call 503-986-0090.

Are you over age 70½ and own an IRA? If yes, the IRS requires you to take minimum distributions (RMDs) from your IRA based on your life expectancy. Under the tax law enacted in 2017, many taxpayers who previously itemized their deductions will now claim the standard deduction, thereby reducing the tax benefit of making charitable donations. However, the owner of an IRA may still donate part or the entire amount of the RMD and avoid paying taxes on the amount of the distribution donated to charity. Taxpayers over age 70½ can make a Qualified Charitable Distribution (QCD) from an IRA; a QCD allows you to donate up to $100,000 per year from your IRA to qualified charities without paying income tax on the distribution. The amount you donate to charity is excluded from your adjusted gross income, thereby reducing your taxable income. If you donate to a cultural non-profit and make a matching contribution to the Cultural Trust, your donation to the Oregon Cultural Trust will be eligible for the dollar for dollar state tax credit (up to $1,000 for taxpayers filing jointly and $500 for singles). The only requirement is that you send the money directly from the IRA custodian to the non-profit and/or the Cultural Trust.

The Oregon Department of Revenue advises donors with questions about the value of in-kind contributions to consult the Internal Revenue Service’s published guidelines; following the IRC allowable contributions is appropriate. Taxpayers must retain documentation evidencing the value of the in-kind contribution.

Our current understanding is that donations to the Cultural Trust from an established charitable vehicle, such as a donor advised fund, are not eligible for the Cultural Tax Credit (as both a State and Federal tax deduction is taken at the time of the charitable vehicle’s establishment). The Cultural Trust can accept donations from a charitable vehicle, but that donation is not an allowable tax credit. The Trust is currently seeking clarification on this issue. To take advantage of the Cultural Tax Credit when making your first gifts from a DAF, make your matching donation directly to the Cultural Trust from an alternate source of funds to qualify for the tax credit. Just be sure to do so by December 31 in the same tax year as the qualifying cultural donation(s).

No, we are unable to accept gifts of mutual fund shares.

Yes. Contribute to the Oregon Cultural Trust through your will, trust or annuity plan and make sure that the Cultural Trust can continue for generations to come. Visit the Planned Giving page to find out more.

No. The Oregon Cultural Trust does not ask for proof of your cultural nonprofit donations. However, we encourage donors to keep all donation paperwork with your tax information, including the donor acknowledgement you receive from the Oregon Cultural Trust.

The State of Oregon Department of Revenue may request proof of a cultural nonprofit donation as part of an audit or as part of a review of your tax credit claim.

60 percent of the funds we raise are redistributed across the state through Statewide Partners, County/Tribe Coalitions and Cultural Development Grants. For fiscal year 2020 (2019-2020), the Cultural Trust awarded $2.7 million in grants. The remaining funds are invested in a permanent fund. Learn more here.

Participating Cultural Nonprofits

You can find over 1,400 eligible cultural nonprofits in Oregon here. If you have questions about the nonprofit status of an organization to which you donate, check this IRS website to view a nonprofit whose status has been revoked.

We welcome applications from Oregon cultural nonprofits who wish to be added to our qualified list. For consideration please submit:

- Proof of headquarters in Oregon (official letterhead is accepted);

- A copy of the Internal Revenue Service letter verifying your organization’s 501(c)(3) tax- exempt status;

- A copy of your mission statement and/or bylaws for review to show that the organization operates with a mission and goals where “culture” is central. This means that the purpose of your organization is rooted in the arts, heritage, history, historic preservation or the humanities.

Note: Applications are reviewed and processed quarterly (January, April, July, October). Please be sure to time your submission accordingly:

- Applications submitted in October, November, and December will be reviewed in: January

- Applications submitted in January, February and March will be reviewed in: April

- Applications submitted in April, May and June will be reviewed in: July

- Applications submitted in July, August and September will be reviewed in: October

Email all materials with a cover letter to Aili Schreiner, Trust Manager, at Aili.Schreiner@oregon.gov. Please do not mail materials.

Cultural Trust Board Meetings

All meetings of the Oregon Cultural Trust Board are open to the public.

2021

Virtual Meeting: February 25, 2021

Virtual Meeting: May 20, 2021

Virtual Meeting: July 29, 2021

Virtual Meeting: September 29, 2021

Virtual Meeting: October 28, 2021

2022

Virtual Meeting: January 7, 2022

Virtual Meeting: February 24, 2022

Virtual Meeting: May 19, 2022

Virtual Meeting: July 28, 2022

Virtual Meeting: October 27, 2022

Virtual Meeting: February 23, 2023

- February 23, 2023 Board Packet

- Board Minutes, February 23, 2023

Meeting: Chehalem Cultural Center, August 31, 2023

- August 31, 2023 Agenda

- August 31, 2023 Board Packet

- Board Minutes, August 31, 2023